Let's start at the very beginning, do not trade, gamble or speculate on any cryptocurrency rising or falling in value with money you cannot afford to lose. You should never use credit cards, loans or any finances allocated to your mortgage, rent or living expenses.

Second rule should always be only playing with house money. This means whether you put in $100, $1000 or $100,000, once you make that money back, you should withdraw it.

We will outline the basic chart patterns in this article. However we would always advise anyone to take a basic chart analysis course before trading.

We believe it's very important to have this basic knowledge so you understand where your money is going, why it's going to a certain place at a certain time, and how it may or may not benefit you to do that.

You should always understand the narrative behind the security or commodity you're trading. For example, in crypto, you should understand what each cryptocurrency is, its utility, and why it may be beneficial in digital finance in the future.

Trading not Investing

Trading cryptocurrency is speculating, it is not investing. Despite a lot of cryptocurrency projects claiming to have utility, they don't in the real world. All the high market cap cryptocurrencies are a commodity, not a security. This means you are not purchasing a share in the company, eg. if you bought Apple stock. Therefore the crypto you are purchasing has no tangible value. To explain it a different way, if you knew Apple was releasing the new iPhone next week, their stock will rise due to their company releasing that new product. That would be an investment in the company and its new product. However, Bitcoin has no stock, it has no product, it has no release date and has no tangible value. Thus, you are only speculating whether you believe the price of Bitcoin will rise or fall without any real reason or proof.

Like everything that is traded, when not enough people purchase, the price action falls. When too many people purchase, price action rises, this is no different for cryptocurrency. However, if you read all the articles written on this website, you will understand that crypto not only goes through cycles but can be analysed through the charts as well. The narrative is also very important for any cryptocurrency. The reason is that any particular cryptocurrencies narrative is its product, just like Apple's iPhone being released, It explains the potential price action.

Let's use Bitcoin as the example, Bitcoin has a four-year cycle, the crypto Winter is when we see price action fall from all-time highs, right until it bottoms out. The spring is when we start seeing a move to the upside, the summer is typically just before and after the halving, seeing price action move back up, normally hitting the previous all-time high. Then we have the crypto autumn which sees the parabolic move to our new all-time high and the end of the cycle. This is our narrative. It's a proven cycle it's happened twice before, and we are currently in the middle of the third cycle since Bitcoin's inception. So, we have the idea, now we can then move to the charts.

A lot of holders of Bitcoin will hold forever, they will purchase, hold and then ride the wave of the cycle. However, if you understand the charts and you understand the analysis of the coin, the smart play would be riding the spring, summer & autumn and then selling.

You can never guess the top. Nevertheless, selling close to the end of the cycle, where one Bitcoin at topped at $69,000, is important. Let's say you sold at $63,000 instead of riding through the winter and seeing your coin decrease in value all the way to the bottom of the last cycle which was $15,500.

So instead of holding 1 Bitcoin worth $15,500, you are holding $63,000 cash. You wait for the bottom in the next cycle’s Crypto Winter and then purchase for 3 Bitcoin for your $63,000. This means that as the crypto spring, summer & autumn come, and we see all-time highs at $200,000, your 3 Bitcoin are now worth $600,000 instead of holding the original one Bitcoin that you had previously and riding the wave which is now only worth $200,000. This is how you understand the narrative of Bitcoin just like understanding a product release narrative with a standard security trade.

Chart Analysis

Patterns are everywhere. Combine those with key indicators and you can basically claim any chart 'fact' you like. I believe it's incredibly important to learn the basics first and then expand your knowledge.

First, go to tradingview.com you can create a free account which will allow you to add 20 cryptocurrencies to your wish list on the right and one key indicator. Once you have the decided to trade crypto, I would advise upgrading your account for a small monthly fee. It removes the adverts, allows limitless coins & wish lists and up to 5 indicators, which is plenty for a novice.

Here you can see I have drawn lines across the screen. These correspond to previous support and resistance. Support is the line from where the price had previously stopped. For example the top white line in the image above shows price action coming down towards it. The white line "supports" the price action from that point. That then forms the support until broken. Price action will either use it as a place of support in the future to bounce off of (which is bullish) or break through that support (which would be bearish). In this case it bounced off which was good news.

Resistance is the opposite. For example the top horizontal green line in the picture. Notice how price action tried again and again to breakthrough that resistance line, but couldn't. Thats a bearish sign. If we broke through, that would be bullish. It couldn't break through because not enough people bought Bitcoin at that price because they believed it would not break through. Almost becoming a self fore-filling prophecy.

This is why the patterns are so important. Once you draw your chart lines of support and resistance, you then need to look for patterns which will explain whether the masses will buy or sell the coin. Which, in turn, will push the price action through a resistance line.

Patterns

Ascending Triangle is the first and most obvious of the patterns to spot forming.This is the pattern you should always be looking for first.

This is when price action finds a horizontal resistance line but has higher lows on support. Often with at least two bounces off each. It comes to a crescendo at the end and more often than not, it breaks through, often to the next resistance line. Entry comes before the break through because thats where you see the greatest gains. If you FOMO (Fear Of Missing Out) after the event, you are already too late. That is one of my 6 rules of trading, which you will see later in this article.

Success rate 75%

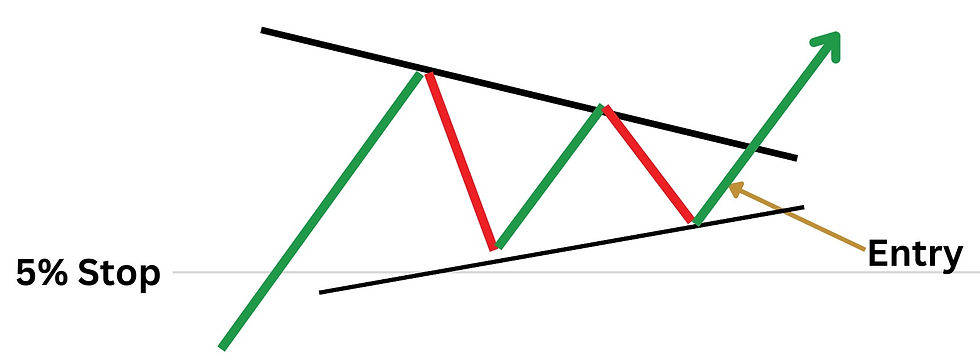

Pendant is very similar to the ascending triangle, however, the resistance isn't vertical. The key for this pattern is higher lows on support. Entry is very important again. This pattern often forms as a consolidation after a large break through of a resistance line. Make sure you are adding your 'Stop' into your trade. If you aren't sure what that is, it will be explained later in this article.

Success rate 60%

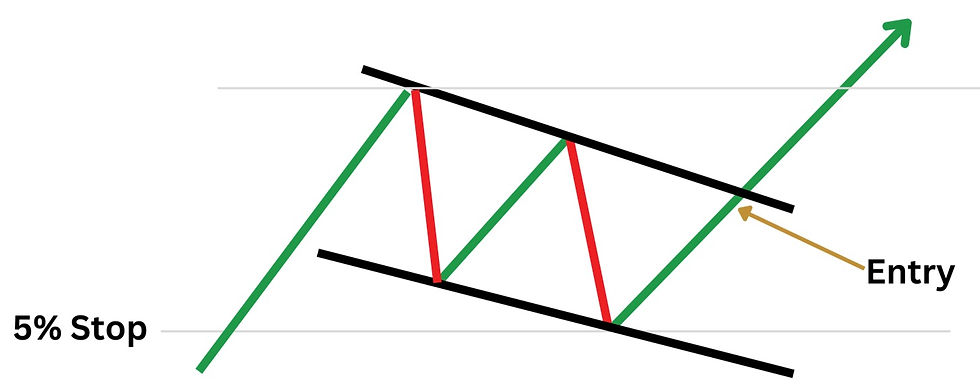

Ascending Flag is again, a positive pattern in a bull market. Price action is rising but we hit descending resistance. This would be a small cause for concern, but remember the build up was bullish. We hit lower lows on the support so our entry to the trade is higher up and our stop loss is at the previous support. On a bull-run this will often become a positive trade. I would never enter on this pattern in crypto winter.

Success rate 50%

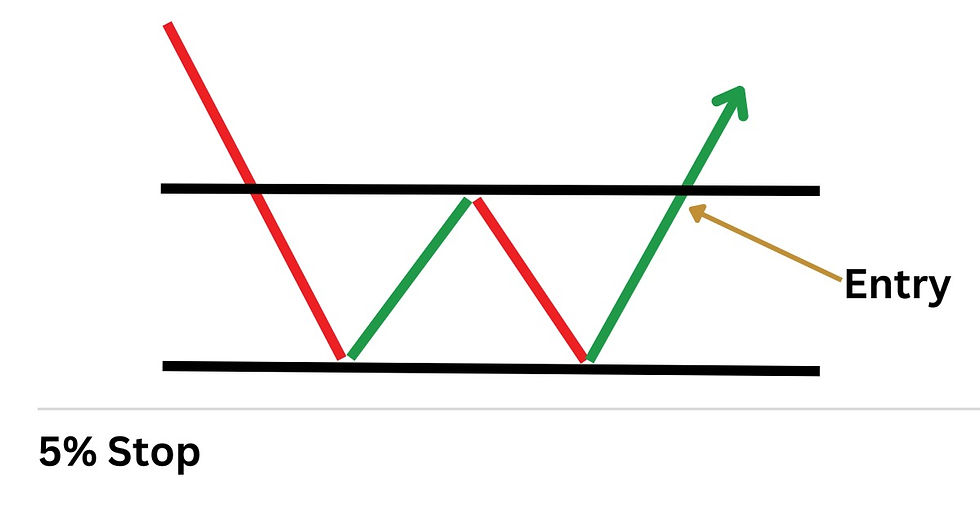

The Double Bottom only gets traded when the narrative changes. If crypto is looking more positive after crypto winter or maybe some positive regulatory news such as the XRP/Ripple case. We will see a support level hit that everyone agrees is enough. We then see an attempted breakout and fail. then a regression to the support but it doesn't fall through that support. The next up turn will be a positive one. You may see the very unique triple bottom but most likely you'll see price action breaking through the resistance.

Success rate 50%

There are a whole host of chart patterns, some good, most are bad. You can research those yourself, but these are the ones you want to look for if you want to enter a crypto trade to take profit. If you are looking to HODL then these patterns and support/resistance lines can help you with when to purchase.

Take profits and Stop Loss

Most believe the smart play is to buy at the bottom, sell at the top, make a fortune. Only if life was that easy. The actual smart play is to take profits on the way up.

This is the Bitcoin 1 Hour chart from March this year. Meaning each candle is 1 hour of price action. Green means up, red means down. We have had a clear Ascending Triangle pattern forming for 3 days. The likely movement is up. Instead of waiting to see what happens and then FOMO in later. We set our Stop loss at 4% lower than our planned entry point.

Entry - $20,350

Stop - $19,530

This means that if price action doesn't break through the resistance line and falls 4%, we will automatically sell our position for a 4% loss and live to fight another day. If we didn't set a stop and the price fell dramatically overnight, we might lose a huge amount of our portfolio in a matter of minutes.

Trading is a percentages game. If half of the time my speculation doesn't come to fruition, I will lose 4% with my Stop. However, if the other half of the time I get it right and make 20%+ then I'm making profit overall.

So we have our insurance policy in place at 4%. What happens if the price action rises? Well, to start with, we have to keep moving our Stop up with the price action. Always only 4% below the price at that moment.

In terms of taking profits, do we wait until we are at the top? Well, no. Who knows where the top is? The price action movement is never a straight line, so what you think is the top, might be just an Ascending Flag pattern and the price continues to grow. This is where taking percentage profits comes in.

Looking at our chart above and understanding the narrative. 2022 has been a the Crypto Winter, the down year of 4 in the cycle. We are in early 2023 and certainly not on a bull-run yet. So we space our 'take profit margins' to suit the situation.

We will take;

25% of our position out at 15% profit - $23,402

25% of our position out at 25% profit - $25,437

25% of our position out at 35% profit - $27,472

Leave the remaining 25% until I see a negative pattern forming and then remove.

You can see this forming in the next two charts.

Across the 8 days between the 12th and 20th of March, I kept moving my Stop up and took profits at my predetermined points. This allowed me to make a great return in a volatile market and set me up for the next trade. The reason I was able to make a great return was 3 main factors.

Understanding the pattern forming. Entering at the right time. Setting my Stop.

Understanding the narrative of the time and setting realistic percentage profit targets.

Allowing others to FOMO in which directly raises the price. Allowing me to reach my higher targets which ultimately makes me more capital.

If we were in a bull-run, I may have widened my percentage profit targets to 25% / 35% / 50% / Leave. With true transparency, in the parabolic run of the last 6 months of crypto Autumn, I would only profit take 50% of my position at approximately 250% return and leave the rest in. But for the other 3.5 years of the cycle. The narrative of the market would dictate my percentage profit targets.

Crypto Exchanges

The reason why BlackRock's Bitcoin Spot ETF is so important is because the everyday retail investor doesn't want to take day-to-day ownership of their investments, nor do they want the responsibility of custody. They want to simply call or email their broker on Wall Street and say they'd like $2000 of Apple stock.

Signing up for an account on a crypto exchange is harder than getting a bank account. Why? I don't know. I'm sure it will become easier one day but for now its unnecessarily difficult. They take loads personal information, which obviously means they are asking for a lot of trust. Something the industry struggles with in the public eye. This all combines to make it harder for retail investors to own crypto in their portfolio.

Once you've completed the signing up process you are now responsible for your account. Which means sole custody, something retail securities traders hate. So crypto has a long way to go to adopt or adapt to the old style of trading.

Which exchange should you join? First you should consider which exchange has Proof of Reserve (PoR) or which falls under strict govenance.

Binance - Has offered PoR but the company that did the audit has now pulled their findings. Binance US is under investigation by the S.E.C. and Binance is Chinese based. Which means we in the west don't really have the confidence that they are working under strict regulations.

Coinbase - Is still in court with the S.E.C. about offering a few coins that went to zero. They believe the S.E.C. are "well outside their jurisdiction" and this will be dissmissed by the courts. This in a way is comforting as an account holder at Coinbase. You know that the DoJ are always keeping them honest. Coinbase have also shown PoR as they are a public company.

Kraken - A simple and easy-to-use platform for beginners. No pending court cases but no PoR either. A good place to start with a few hundred dollars though.

Bybit - Popular with the YouTube community and professional traders. No clear PoR but does have open wallets with mountains of Bitcoin in.

Kucoin - A retail platform that does provide the obscure meme coins that 100x and then crash. Probably not worth looking into.

OKX - Chinese owned and does have a spotless history throughout all it's different guises. However, i believe there are better options.

If I was going to start from scratch, I would open a Coinbase account. Their platform is easy-to-use on both desktop and mobile. They are a public company which keeps them honest and they don't own a coin, means we won't see an FTX situation. Something we may see with Binance one day. Coinbase are regulated by the US DoJ and its on the easier end of the signing up scale. For a beginner, this is the place to start trading.

6 Rules of Trading

Always take percentage profits.

Set 'Stops' & stick to them. Getting out at -5% is better than hoping and losing 25%.

A great trader only gets 50% of trades correct.

Don't get emotional or hopeful. Head always rules heart.

Charts don't lie. If it's time to buy or sell - it will be obvious.

Never buy with FOMO. If you're not in early, you're not in.

It's always important to remember that like any skill, trading needs to be practiced and allow learning from your failures without frustration. Don't be discouraged by trades that don't go your way. Start small, enjoy the journey, stick to the 6 rules and over time you will learn to see patterns and trades which will greatly enhance your skill and earnings.

Disclaimer - None of what is written on this website is financial advice, and only offers descriptions of how the author trades. These articles are purely for entertainment purposes.

Comentários