It's not the biggest, it's not the longest, and it didn’t lose the most money, but Sam Bankman-Fried's FTX fraud may well be the most extraordinary scam in history.

In just three years Sam Bankman-Fried started FTX and turned it into a $32 billion company. Donated $40 million to American political candidates, an equal amount to each side of the aisle, which gave him huge political influence. He got celebrities and elite sports people falling over themselves to give him billions of dollars to be an investor. He became the chief digital finance adviser to the government of the United States. He sponsored stadiums, teams, and athletes. He purchased $300 million worth of property in the Bahamas and dozens more around the globe… and lived and worked out of a single apartment, with his ten roommates, as a scruffy 20 something.

This is the story of the 'crypto genius' who fooled the world.

Everyone likes a story about an underdog, someone out of the ordinary. An unlikely genius that comes once in a lifetime. Someone who wants to change the world for good. This isn't one of those stories.

“In the end my goal is to do as much good as I can for the world. This isn't bullshit, I really do mean it.”

Sam Bankman-Fried when interviewed about being the most generous man in the world in 2021.

Around May of 2022 a gentleman named Marc Cohodes started publicly broadcasting his views about FTX and Sam Bankmen-Fried (SBF) on Twitter. In the world of finance Cohodes is what you would call a short seller, somebody that bets against the success of a company, and if he's right, he makes money. Only a few months after his initial tweets, he had sent an e-mail to Bloomberg asking them to investigate Sam Bankman-Fried and FTX. Cohodes was skeptical and one of his biggest questions was related to SBF and his background. He wanted to know who was this guy? and how did he become the crypto king in such a short period of time?

Effective Altruism

'To save the world don't get a job at a charity, go work on Wall Street' that was the title of a post on a forum in 2013, nine years before the FTX collapse. It was written by William McCaskill he is a professor of philosophy at the university of Oxford but more importantly, the cofounder of the Effective Altruism movement. Effective Altruism is a philosophy and a community that's about trying to ‘do as much good as possible with the time and money we have’. One strategy was known as ‘earning to give’ which meant maximising your own wealth so that you could give away to charitable causes. Someone who works in finance at a trading firm Jane Street proclaimed "get filthy rich for charity’s sake". He is currently giving away 50% of his income to charitable causes. In that same year of 2013, McCaskill heard of another MIT student that may be a good fit for the movement, a 24 year old physics undergraduate who went by the name Sam Bankmen-Fried, and just like that SBF was introduced to Effective Altruism.

SBF was a mathematics nerd with a passion for utilitarianism and a vegan, who already engaged in animal rights activism. McCaskill persuaded SBF, instead of working for a charity directly, he could make a greater impact by pursuing a high paying career then donating a substantial amount of his income to charitable causes. SBF was convinced, and decides to get a job at the same trading firm, known as Jane Street. It was a popular firm amongst other Effective Altruists, little did McCaskill realise just how much damage his new convert would cause the movement in the years to come.

After 3 1/2 years of working at Jane Street, SBF decided to quit. He had an appetite for risk and by staying there he felt like he could be missing out on other opportunities. One of his colleagues at the time, a 22 year old named Caroline Ellison, witnessed it herself. Just like SBF, she too was an Effective Altruist with a love of mathematics, but more on her later.

Sam starts writing a list of directions for his life, those things included becoming a journalist, venturing into politics, fundraising for a nonprofit and building a startup, he would go on to achieve almost all of those things but before making a decision, William McCaskill offers him a job at the center of Effective Altruism. He would accept a role at the EA movement and whilst there he befriends another member, Tara McCauley, who was head of operations. That's when Sam started noticing something interesting.

Alameda Research

At this point SBF didn't have much of an interest in cryptocurrencies, but in 2017 the cryptocurrency world was entering a parabolic run and it got on Sam's radar. Talking about that time SBF said “When you walk down the streets you hear people talking, you're like that's probably about bitcoin, I don't know it for sure, but you know it’s pretty likely.” This frenzy sparked something in SBF that he believed no one else had spotted. He needed to act fast, in that same year, SBF and his fellow colleague Tara McCauley start a new company together, they call it Alameda Research.

Alameda sounds like a research company which was intentional misdirection. SBF stating “…if you name your company like a cryptocurrency, no one's gonna give you a bank account. But everyone wants to serve a Research Institute.”.

Alameda's true purpose was to operate as a cryptocurrency trading fund in other words they would be using their own money to invest into crypto related assets in order to make a profit. Like I mentioned, SBF had noticed something. To purchase Bitcoin, most people use exchanges, and the price of Bitcoin generally remains the same across all exchanges in the world, with one exception. At the time some countries in Asia had been selling Bitcoin for up to $5000 more than what it was on other exchanges. However, there were far too many obstacles in the way such as capital controls, financial regulations, anti money laundering laws and so on. Most people couldn't work out how to make the trade, Sam however, had a card up his sleeve. With the help of a Japanese member of the Effective Altruism community Sam was able to skirt around some of these obstacles. SBF also secured funding from wealthy Effective Altruist members, specifically a loan for $50 million from Jaan Tallinn the cofounder of Skype.

Alameda Research would first buy Bitcoin on a US exchange, then sell it at a higher price on a Japanese exchange with the help of their Japanese friend. Making approximately $30 million in the first couple of months. However, opportunities like this don't last forever. Once people start to catch on, the markets adjusted themselves and it no longer became profitable by January of 2018. Alameda could no longer exploit the opportunity and then something happened in April, an event that would be kept secret for a long time, an event that would expose a side of his character that would foreshadow much of what was to come.

April Fiasco

In April 2018, co-founder of Alameda Research Tara McCauley was growing frustrated. Whilst their initial trades of Bitcoin between the US and Japan had been successful, they were now losing money and most of that blame was being put on the other co-founder Sam Bankman-Fried. There was growing concern over Sam's reckless actions, including poor trading decisions. In a post made on the Effective Altruism forum, an employee describes how he constantly displayed “A flagrant disregard for legal structures and safeguards. A belief that rules do not apply to him" and "...an inclination to see the ends justifying the means.”. The picture they paint was not of a genius, but of a young, inexperienced, reckless individual who was harming the company with poor management and trading decisions.

So, Tara, along with other high level employees, decide to confront SBF. They tell him directly to leave the company because his behaviour would no longer be tolerated. This was the month of April, 2018, known internally as the April Fiasco. SBF refused to leave, which prompted Tara McCauley and half the employees at Alameda Research to pack their bags, they were done. Former employees would raise concerns years later, warning of Sam's reckless behaviour and how he was a bad representative for the EA movement and Alameda Research. Those allegations were ignored and not taken seriously for years. By the time people would find out about the April Fiasco it would already be too late.

New Beginnings

With a large chunk of his employees gone from Alameda Research, Sam had to reestablish his new team. First, Gary Wang, he joined Alameda Research from its inception and was only 24 years old. Wang supposedly met SBF at a math summer camp in 2008. He was very much the technical brains of the business.

Nishad Singh was a Facebook employee for only five months before joining Alameda Research aged 21. Much like Wang, he helped with the technical infrastructure at Alameda.

Then you have Caroline Ellison, remember her? the former colleague of Sam's at Jane Street. Sam managed to convince the 23 year old to leave that job and join Alameda Research.

Andy Croghan, he was the adult in the room at 28. There is no picture of him on the internet but i've been assured he does actually exist. The former employee to another trading firm and now the Chief Operating Officer of Alameda Research. He had once told Sam to cut his hair to which SBF replied “I think it's important for people to think I look crazy”.

The very young Alameda team decided to put together a pitch deck, a presentation that's designed to attract potential investors to invest their funds with Alameda. It was filled with all sorts of insane claims “we're the best crypto trading firm in the United States” & “we haven't had a losing week in six months” almost childish claims. To claim no risk and to say that they hadn't had a losing week in Crypto, it’s outrageous and shows their inexperience.

Alameda was desperate, for months that pitch deck was unsuccessful but that didn't matter because SBF had been working on a secret project. He wanted to start an exchange.

Who made money in the Gold Rush? The guy selling the tools.

Crypto Exchanges make their money by charging a fee for every trade a person makes on their platform, in other words they make money regardless of whether the person making the trade is winning or losing. In May of 2019, SBF launches a brand new cryptocurrency exchange FTX. He would be the majority owner whilst Gary Wang who helped build the infrastructure would own 10%. Sam now owned both a cryptocurrency exchange and a cryptocurrency trading firm.

There's something already bizarre about all of this and not just the fact that these companies are being run by young and arguably inexperienced & immature people. More importantly the conflict of interest, owning trading firm Alameda Research which uses FTX as a platform. How exactly does FTX ensure that no special privileges (insider knowledge/loans or fees) are given to Alameda?

FTX started very successfully thanks to Alameda Research, they provided trading volume to the exchange right from the start. By July 2019 SBF was already in talks with investors and by August that same year they managed to raise $80 million, not only were they getting investments from venture capital firms they were also raising money from their competition.

Binance sit right at the top of Crypto. It is the largest crypto exchange and has it’s own token BNB which trades for hundreds of dollars each, all owned by a gentleman named Changpeng Zhao (CZ for short). In December 2019, Binance invests $100 million into FTX for a 20% equity ownership in the company. This sparked what seemed to be a friendly relationship between CZ and SBF. Little did Sam realise the man who invested that money into his company would deal the final blow to his empire years later.

Despite the young age, perhaps one of FTX’s smartest moves was the creation of FTT Token. A piece of the puzzle that would become instrumental in the years to come. In the world of cryptocurrencies anyone can start their own Coin or Token. All they are is programmable money put on a database. However, others might call it ‘Magical Internet Money’ created from nothing that has no real value or utility, other than what people speculate its value to be.

On July 29th, 2019, FTX launched their token coin called FTT where the total supply of 350 million Tokens, most of which was owned by Alameda and FTX. The launch was a success, by August the price of FTT rose to $1.81 which made FTX and Alameda supply of FTT tokens worth over $700 million. Just like that Magical Internet Money had created real cash. However, the truth is, since they were the majority holders of the token, they could never really sell all of it, it would just make the price of the tokens completely crash. So, what they did was use their FTT tokens, that were valued in the hundreds of millions of dollars, and use it as collateral to take out loans. Simply saying 'oh look how much we have in assets, even though part of that is really just FTT tokens that we created, whose value is mostly tied to speculation' it's almost insane to think about. But it worked.

In the summer of 2021, Sam Bankman-Fried gets on a zoom call with partners of Sequoia Capital, a venture capital firm who had invested in Apple, Google, Instagram and dozens of other successful tech startups. SBF was there to talk about FTX in the hopes of convincing Sequoia to invest the company. He tells them about his vision for the exchange. How it will become "the place where you can do anything you want with your next dollar" & "You can buy Bitcoin, you can send money, in whatever currency, to any friend anywhere in the world” They were so impressed, they lead a round of investment for FTX which totalled almost a billion dollars.

A year after that zoom call, and two months before the FTX collapse, Sequoia Capital releases this 45 page article titled ‘Sam Bankman-Fried has a saviour complex and maybe you should too’, in that article they revealed that throughout the zoom call Sam had been playing one of his favourite video games ‘League of Legends’. The article goes on to talk about Sam's commitment to the Effective Altruism movement, and when the author sits down with SBF for an interview, he becomes convinced that Sam may well become the world's first trillionaire, and even goes far as saying that “unlike other crypto companies, FTX has a unique selling point, their ethical behaviour”.

When you click on Sequoia's website and the SBF article they wrote declaring Sam to be the first trillionaire and claiming their USP is their "ethical behaviour". I assume they retract their statement now.

There was this image of who Sam was, that people were buying into, an Effective Altruist, a crypto genius, a nerd who played video games whilst casually pitching billion dollar investments to Sequoia.

The crypto genius was an exceptional case, one everyone wanted to buy into him. Big institutional names investing into FTX were Temasek, SoftBank’s Vision Fund, BlackRock & Ontario Teachers’ Pension Fund. Remember 2021 was the year that everyone saw crypto as this fountain of wealth for those that put their money into it, they were seeing huge returns in the hundreds of percent. But now FTX needed to reach the retail investors. To reach these people FTX had to do one thing… get in front of the things that they cared about.

The Miami Heat arena famous for hosting the Miami Heat NBA team, in March of 2021 it became the FTX arena after signing a 19 year deal for $135 million. This was the start of the big spending to get mainstream name recognition. TSM, the most popular esports organisation, most known for their League of Legends team was now called TSM FTX, thanks to a 10 year deal worth $210 million. FTX was putting their name everywhere. Seven time Superbowl winner, Tom Brady, one of the greatest quarterbacks in American Football history, he's not only an ambassador for FTX, he's also given equity in the company and the same goes for the Brazilian fashion model, Gisele Bunchen, Brady's wife at the time. The entirety of Major League Baseball was a five year partner of FTX, Formula One Champions Mercedes-Benz, the International Cricket Council, NBA Champions Golden State Warriors and their star player Steph Curry were sponsored.

Even Kevin O'Leary, one of the sharks on the popular show Shark Tank, who had been rather critical of the cryptocurrency space up until this point, signed a $15 million deal with FTX to become an official spokesperson. I’m not including some of the popular finance influencers on YouTube, who generally gave safe investment advice, even they were taking on sponsorship deals with FTX. SBF & FTX were fast becoming the face of the digital finance industry.

Politics & Regulation

Sam Bankman-Fried always wanted to get into politics since leaving Jane Street many years earlier, and in 2021, he had a strong reason to follow that calling. Binance had been in trouble in a lot of countries, in terms of regulatory issues. Binance, the world's largest cryptocurrency exchange, got banned in the United Kingdom, Ontario Provence in Canada and not authorised to operate in Japan, Singapore or the Netherlands.

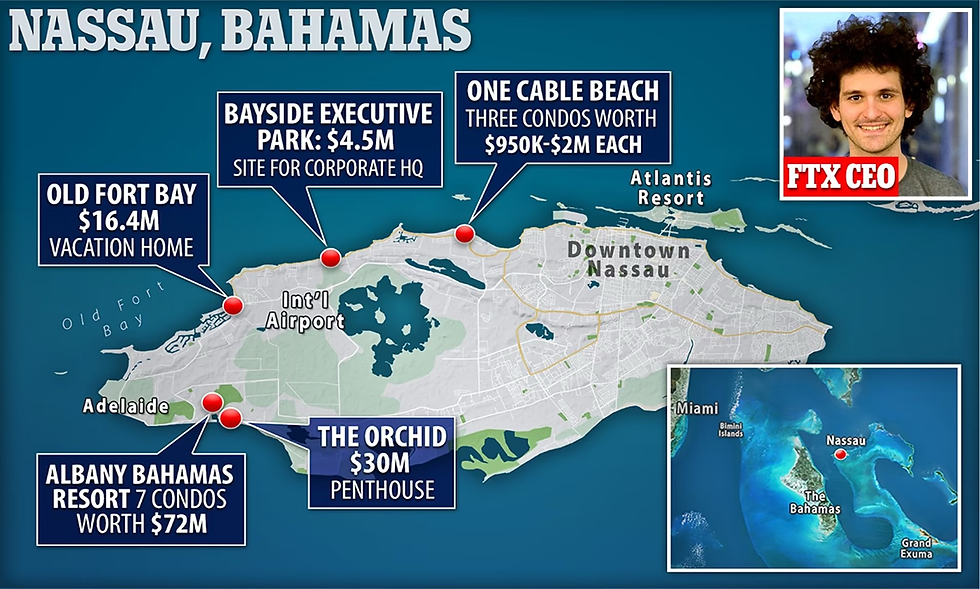

SBF wanted to make sure that FTX wouldn't go down that same path saying, “All I'll say is that we try really hard to be as cooperative as we can with regulators”. In September of 2021, FTX was granted regulatory approval in the Bahamas, not long after that, SBF relocates the headquarters of both FTX and Alameda Research to the city of Nassau. Sam saw the Bahamas as a country that could be at the heart of this industry, a Silicon Valley for crypto, but in all honesty a place that would keep him safe if it all went wrong.

That wasn't the only place Sam had his eyes on throughout 2021, he was looking at another prize, Washington DC. Only months after moving to the Bahamas, SBF recruits a new member into the FTX team, a chap called Mark Wetjen (right). Who was a former commissioner for the CFTC, a regulatory agency in charge of derivative markets in the US. In other words, he was Sam's key to the doors of US politics and regulation, what followed was pretty impressive.

SBF in a Congressional Hearing in 2021.

Only a month after the hiring of Mark Wetjen, Sam appeared in Congress to testify for a hearing on digital assets and the future of finance in the IT industry. He had the potential to improve a lot of people's lives, promote Decentralised Finance (DeFi) and the crypto space in general. However, rather than resisting Congress’ ill-informed ramblings about digital finance, he listened and agreed with them, then told them that the space needs governmental regulation. Something that completely goes against the crypto ethos and something that would bite him in the arse later.

FTX went on to make regulatory wins throughout 2021. Becoming chums with Washington, knowing they wouldn’t investigate FTX while he was friends with them. But how could he secure his position? SBF went on to become the 6th largest US political donor in the two years leading up to the midterm elections, over $40 million in donations split evenly between the two parties. Other FTX executives had also contributed huge sums. By the end of 2022, political donations associated with SBF and FTX executives exceeded $70 million.

“He is the devil in crypto, this guy's literally trying to ruin crypto permanently and you know what he says “oh that's not what I'm doing” … you’re a liar! you lie!”. This was the outburst by one prominent crypto analyst on YouTube. SBF's political ambitions and distinct lack of care for what crypto is at it's heart had started to rub people the wrong way. One of the bills that Sam had been supporting was known as the DCPA, a bill that would essentially make the CFTC the sole regulator of the crypto industry, but many in the crypto space accused this bill of being destructive to the cryptocurrency ecosystem. To allow any one entity to claim a monopoly on the industry would be disastrous.

Ultimately Sam Bankman-Fried was trying to get some kind of legal monopoly over the crypto industry. There was kind of culture of silence in crypto around that time of not opposing him or his views. He was the chosen one after all. Everything he touched turned to gold. On reflection though, perhaps this period exposed a side to SBF that people hadn't seen before, the part of him that believed that the ends justify the means or a desire for his crypto empire to come out on top no matter what that does for the industry. If people would have known what happened at Alameda Research in 2018 during that April Fiasco, then perhaps everyone might have seen all this coming.

Investors believed in SBF or at least the very idea of him, allegedly Andy Croghan would make sure that investors visiting, would be able to see Sam sleeping on a beanbag, in the dingy office he shared with his 10 colleagues. He would have him wake up and enter the meetings, usually wearing shorts, it was intentional, Sam knew that more powerful than just a balance sheet is the narrative or the genius that wakes and makes billions. Almost a godly touch.

SBF would frequently sleep on beanbags on the office floor of FTX.

When the tables turned

By early 2022 FTX had raised billions of dollars from investors and was valued at $32 billion. However, not a single one of FTX's big name investors sat on the board of directors to oversee Sam's operations, which was usually common practice. Investors would report that Sam wanted to run his company with little oversight and if anyone was interested in investing, they should support that decision, take it or leave it.

In July of 2021 Sam solidified his ownership over his empire when he decided to buy back Changpeng Zhao (CZ), the founder of Binance, stake in his company for $2 billion of FTT tokens. In return Sam Bankman-Fried was the reigning owner of his empire. His focus primarily on FTX & Alameda Research, which was being run by two individuals, Caroline Ellison and a 27 year old named Sam Trabucco (Left). He joined Alameda as a trader and first met SBF at a maths camp in 2010, and then two years later reconnected at MIT.

There were some pretty bizarre tweets made by Trabucco in 2021, one tweet detailed an Alameda strategy of holding a position in Dogecoin, a hugely volatile cryptocurrency created from a meme, based on tweets by Elon Musk. In that same tweet thread Trabucco brags about their ability to make good bets. Obviously not Mr Trabucco, Dogecoin is down 900% since that tweet. It paints a picture that Alameda Research doesn't seem like a place with sophisticated individuals, making calculated trades, based on proper risk assessment. Yet more a university dorm full of math nerds that believe they are better than the mainstream. SBF ended up promoting both Ellison and Trabucco to coCEO positions in Alameda in October of 2021.

In May of 2022, a catastrophe in the cryptocurrency space was unfolding Terra and LUNA & UST had just crashed in value, wiping out an estimated $60 billion in the crypto space. The collapse was like being jolted awake after a dream about falling. Everyone was on high alert because everyone is looking around and asking 'who will be the most affected by this? who will be next the domino to fall?'. First it was crypto hedge fund Three Arrows Capital, ordered by a court to liquidate. It had exposure to the now collapsed Terra UST stable coin. Everyone was intertwined in some way. People were losing life savings and the third largest coin my market cap had been lost. Voyager Digital files for Chapter 11 bankruptcy, the crypto lender went from managing billions in assets to filing for bankruptcy in 8 days. Celsius was the third major crypto company to file for bankruptcy because of this collapse. Crypto.com were laying off 25% of their work force. It seemed like end of days stuff for the industry.

Nevertheless, while all this was going on, FTX and Sam Bankman-Fried were not only doing fine, but they were also doubling down. Sam was trying to rescue some of the companies that were going bankrupt, either giving them a line of credit or just completely buying them out. Reports at the time were stating that SBF & FTX were “keeping the industry afloat” and “keeping prices stable”. FTX bought Voyager for roughly $1.4 billion. Sam's empire wasn't shrinking amongst the chaos, it was growing. He was being pitched as this saviour. Mainstream media were calling him the "JP Morgan of the cryptocurrency industry". However, before praising SBF, they forgot to actually look at what's really going on. They didn’t question how FTX have capital while everyone is in crisis. If they had asked that question, do you think SBF would have asked honestly? “It’s all customer funds. I hope they don’t ask for it back”.

Leading up to the collapse in November 2022, some things started happening in August. Sam Trabucco resigns from his position stating that he's chosen to prioritise “other things”. A month later, Brett Harrison president for the US subsidiary of FTX resigns from his position. Then a month after that an article comes out saying that Jonathan Cheeseman head of Over the Counter and Institutional Sales left FTX as well. Something was up, SBF had managed to build himself this empire in only a few years but the throne that he was sitting on was made of glass and it was about to be smashed to pieces by the infamous Coin Desk report.

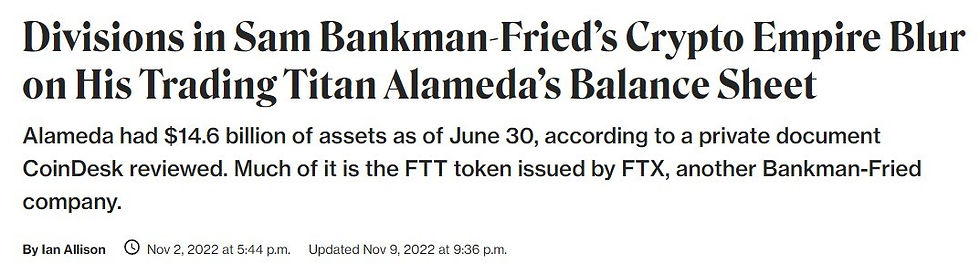

CoinDesk Report

CoinDesk, a well known cryptocurrency publication, published an article titled ‘Divisions in Sam Bankman-Fried’s Crypto Empire Blur On His Trading Titan Alameda's Balance Sheet’. Someone had leaked Alameda Research’s balance sheet and CoinDesk had managed to get their hands on it. A balance sheet can tell you a lot about the health of a company, namely how much money they have access to and how much money they owe.

That CoinDesk report outlines that there are two divisions to Sam Bankman-Fried's empire, FTX is his crypto exchange and Alameda Research his crypto trading firm. This we already knew. Even though these two divisions were supposed to be completely separate from one another, CoinDesk stated that those divisions had become a little bit blurry when you look at Alameda Research’s balance sheet. Out of the $14.6 billion of assets shown on Alameda Research’s balance sheet, a large portion of those assets were the FTT token. In other words, the majority of Alameda’s equity was coming from an illiquid crypto token created by their own sister company. That report confirmed the fears that FTX and Alameda are closer linked than previously imagined what followed would be a week of disaster.

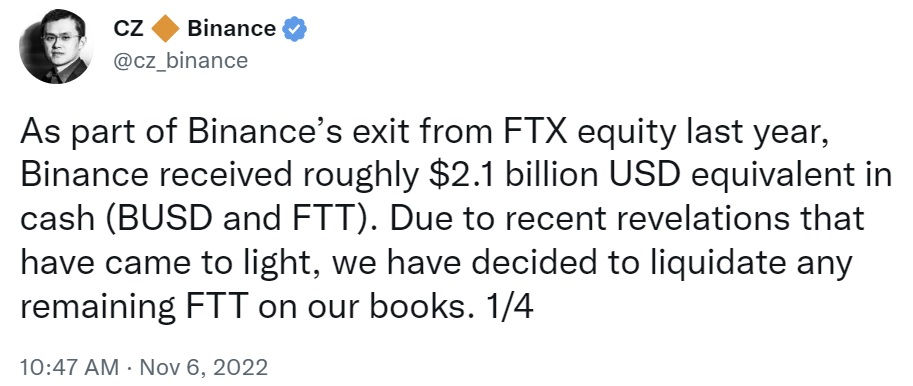

Twitter Spat... to the Death

When it was disclosed that FTX and Alameda are closer linked than previously imagined, CZ, the founder of Binance, tweeted to his millions of followers that he plans to sell all of the FTT tokens that Binance holds. If you remember, Binance had received $2 billion of FTT tokens when SBF repurchased Binance's shares in FTX a year prior. With that single tweet alone, the shit hit the fan.

The most infamous tweet in crypto history. Published by CZ, CEO of Binance.

With Binance liquidating their FTT tokens, this would mean it would drive down the value of FTT in the process. However, perhaps even worse was the panic that that tweet caused because from the outside it seemed that Binance, the top crypto exchange in the world, didn't believe in FTT or FTX anymore.

A few hours later Caroline Ellison published a tweet asking if CZ would be willing to sell his FTT tokens directly to Alameda Research for $22.00, in other words preventing a massive crash in the price of FTT. Of course, that would be to Alameda’s benefit, given that most of their assets were literally made-up of FTT tokens and CZ selling FTT would make their tokens worth considerably less.

CZ refuses with the now infamous tweet “we won't pretend to make love after divorce” and “we won't supply people who lobby against other industry players behind their backs”. All that political lobbying SBF had been doing had clearly pissed a few people off. What was happening was a showdown between the two biggest cryptocurrency players in the world. A fight to the death.

FTT token chart for the end of October to the collapse on November 8th, 2022.

While all this is happening the value of FTT tokens has been dropping rapidly. $18. $14. $10. Panic and fear in situations like this are lethal. If you know CZ, you know he never sells anything. He has a policy of long term holding and the way he framed it made it sound like something was truly wrong with Alameda. The way CZ said it, it wasn't just a reflection on Alameda, it was a reflection on SBF & FTX as well.

Lets face it, if you had your money deposited in FTX exchange, holding Bitcoin, Ethereum or any other coin, all your lives trading savings, and you find out its sister company is facing troubles. Then another titan of the industry states he doesn't want anything to do with FTX anymore, what would you do?. Well, you'd probably want to get your money out.

Run on the Bank

Suddenly there is massive outflow of capital from FTX. All of a sudden everyone starts getting scared. In banking there's this concept known as a ‘Bank Run’. If people start to lose their confidence in a bank for whatever reason, customers are likely to start withdrawing money from their accounts. However, if the bank doesn't have enough money in its reserves to fulfil all those withdrawals, it ultimately collapses.

Crypto exchanges sort of operate like that, you deposit your money into them, and for the most part, your money stays in that exchanges account until you eventually withdraw (they simply make money every time you trade). In this moment anyone who doesn't want to withdraw their capital will still look at everyone else who is and think, “I didn't want to withdraw, but I also don't want to be the victim of a bank run, so, I kind of have to.” It's a pretty deadly cycle and nothing fuels it better than panic and confusion.

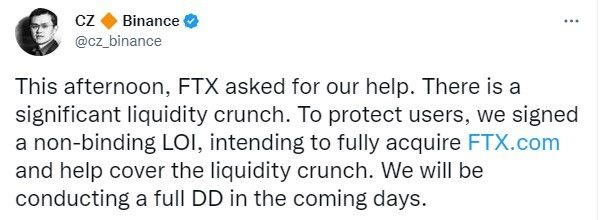

As the withdrawal requests on FTX start piling up Sam Bankman-Fried puts out a tweet saying that “FTX is fine” & “There's nothing to be worried about. We have enough money to cover all their customers deposits.” And then there's silence.

Suddenly CZ tweets that FTX has asked for his help. He's saying that they were facing a liquidity crunch, and he signed a non binding letter of intent to buy out his rivals company and save them from their time of distress. Only a day after, Bloomberg and the Wall Street Journal both publish articles stating that for months the SEC and the CFTC, both US regulatory agents in charge of securities, have been investigating FTX. Specifically whether FTX has been mishandling customer funds.

Up to this point the biggest concern was FTX having a liquidity crunch, being unable to fulfil on customer withdrawal requests, these investigations though, they were suggesting something much more sinister. CZ had announced that “as a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds, we have decided that we will not pursue the potential acquisition of ftx.com”. That was it, the death sentence for Sam Bankman-Fried.

He released a Twitter thread saying that “he's sorry”. He said that he's going to “do right by the users that he's doing everything he can to raise liquidity” and that “they're in talks with a number of players.” Then one day before the collapse… “FTX has filed for Chapter 11 bankruptcy”. From a $32 billion company to bankruptcy in a matter of just four days. There was a sense of ‘what just happened?’ ‘What has Sam been hiding?’ ‘Why has this happened?’ It was time for all this to come to light.

Just a few days after declaring bankruptcy Sam begins his now infamous tweet thread which just began cryptically as one word “What” over the next few hours he starts tweeting a string of letters eventually forming the word “happened”. It’s difficult to understand what's he was going through at this point. Was it shock? Was it incompetency? Did he actually love the fame and attention? Whatever it was, it was ill thought out.

Then came the media reports about how FTX may have been taking customer deposits and loaning them out to their sister company Alameda Research, some figures citing $10 billion worth of loans. Now you have a situation where not only has the fall been so sudden, but now there are accusations of serious fraudulent behaviour.

Author's Note

I want to pause here for a second. Loaning customer funds to another entity or company so they can make money and then repay those loans, so the customers can withdraw their funds when they wish, is exactly how every single bank in the world works. Although banks operate under the rules of that country’s financial regulations, all banks in the world do not hold a $1 for $1 of the customers deposits in house, they do use their customers deposits to make more money.

Do I believe SBF to be evil, probably. Do I believe he actively tried to defraud customers of billions of dollars, certainly. Do I believe he was trying to implement the current banking system into the crypto world, absolutely. Are there regulations on crypto exchanges, no. Should there be, yes. Is it terrible that people lost life savings, unquestionably. However, if you do your due diligence when investing or speculating in any security or commodity you should be aware of all these basic facts. I’m not blaming people, far from it, but SBF was only doing what bankers have been doing for 150 years.

People were angry, they were basically picking up their pitchforks and saying “who is responsible for this?” and of course, some of the first people to feel that anger were the former promoters of FTX. Tom Brady, Giselle Bunchen, Larry David, Naomi Osaka and Steph Curry are among the celebrities accused in a class action lawsuit alleging that the crypto platform FTX misled customers leading to billions of dollars in losses.

What was worse was Kevin O'Leary saying after the collapse that FTX was still a great firm and “I don't think that guy has an evil bone in his body” Kevin O'Leary was going around on TV still standing up for Sam Bankman-Fried “You can love him or hate him given what's happened, but he was one of the most brilliant traders in the crypto universe.” No Kevin, he wasn’t.

From Enron to FTX

People wanted answers, then came the bankruptcy filings from John J. Ray.

“In my career I have never seen a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.” Those were the infamous words from John J. Ray. The new CEO of FTX, whose job it was to preside over the bankruptcy proceedings. John was the same person who oversaw the bankruptcy of Enron, one of the largest cases of corporate fraud in American history. In the FTX filings John Ray paints a picture that starts to look really daunting.

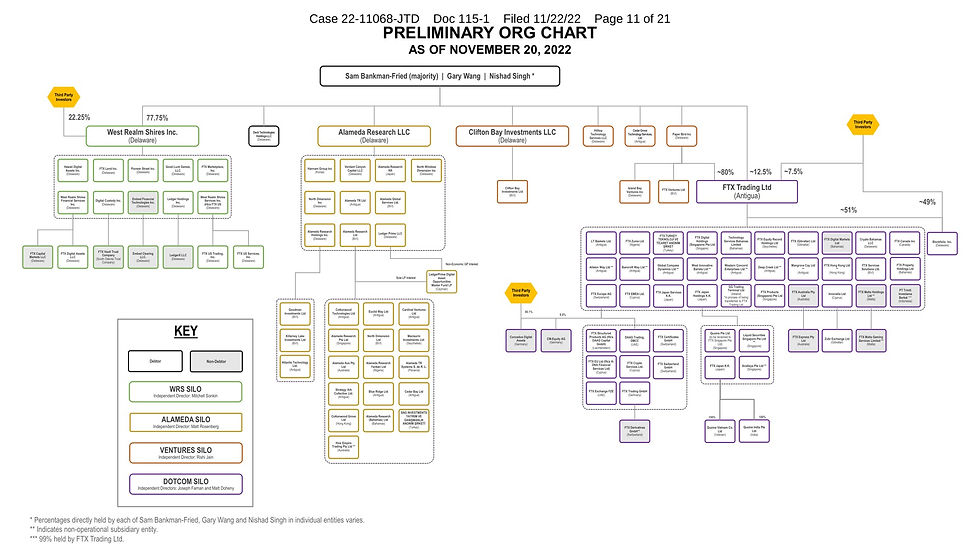

Firstly, have a look at this diagram. This is just a taste of how convoluted and complex SBF’s empire really was. Every single box you see is a company, all of which fit under a particular silo of the empire, including Alameda Research and FTX. All of which have their majority ownership tracing back to Sam Bankman-Fried. John Ray outlines how “the empire fell under the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals”.

The information that came out of these filings became more and more insane. SBF had supposedly been using apps to communicate with senior members of his staff which was set to auto delete messages after a short period of time, and actively encouraging other employees to do the same. Leaving no paper trail. They had been using software to conceal the misuse of customer funds. One part in particular mentioned how Alameda Research was specifically given an exemption from the Auto Liquidation Protocol, which is a mechanism designed to stop customers on FTX from borrowing more money from the exchange than they should be. Simply put… borrow as much as you want Alameda… trade without consequences.

However, the most amusing part of these filings, which was honestly mind boggling, FTX, a financial institution worth approximately $32 billion, didn't have an accounting department or a single accountant on their books.

The Aftermath

With what was going on, I think most people expected Sam to go on the run or at least hide and stay silent. That couldn’t be further from the truth. The first big announcement came from the New York Times, they were hosting an event with some well known speakers and among those speakers was none other than Sam Bankman-Fried. The shock to everyone was threefold.

Firstly, that Sam is still active and staying in the Bahamas seemingly facing no consequences for what's happening. Second, that the New York Times is platforming what may be the biggest financial criminal of the last decade. Finally, that he isn't running, he's doing media interviews and presentations. SBF stated “I didn't ever try to commit fraud on anyone, I was excited about the prospects of FTX a month ago”. When asked “was there commingling of funds and whether he knew that FTX deposits were being funnelled to Alameda?” he replied, “so I was vaguely aware that some wires were being sent there” It was becoming clear in the weeks after the collapse that SBF believed he could talk his way out of this mess. That possibly he’d bought enough political influence to skip criminal charges.

While Sam had all the limelight it wasn't quite clear what was going on with other players in the story, Caroline Ellison had been missing. Gary Wang also became a topic for conversation, namely, Who the hell was he? Where did he come from? because when you google Gary Wang there is one picture of him and one picture of his back facing a computer, that’s it. Apparently, he was an advisor at Sequoia, but hadn’t been involved in the financial sector in any official capacity.

There were allegations of SBF’s family spending up to $300 million on property and his inner circle of 10 people under 30, being roommates, in a single apartment. Tweets by Caroline Ellison were made public about her use of amphetamines and other drugs. A picture was being painted of young, inexperienced, and reckless executives running a company responsible for billions of dollars. Some in the media described it as an “operation ran by a gang of kids in the Bahamas”.

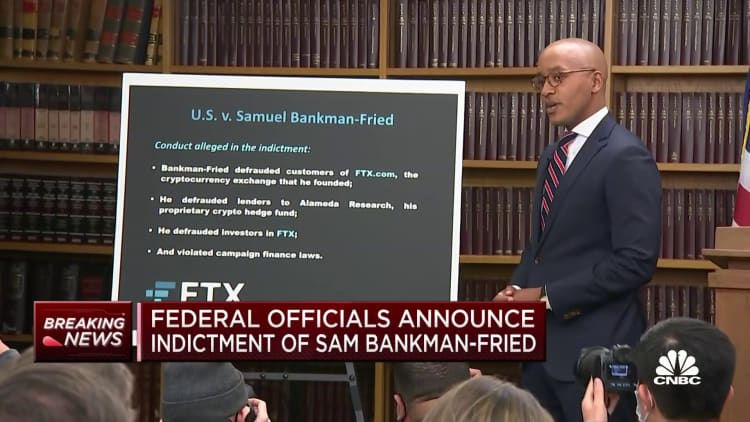

Then finally on the 12th of December, SBF was eventually arrested in the Bahamas at the behest of the United States on 8 counts of conspiracy to commit wire fraud on customers and lenders. Securities fraud, money laundering and violation of campaign finance. Followed shortly by both the SEC and the CFTC filing complaints against Sam Bankman Fried and FTX. Those documents alleged SBF raised more than $1.8 billion from investors, unbeknownst to those investors SBF was orchestrating a massive years long fraud, diverting billions of dollars of the trading platforms customer funds for his own personal benefit and to help grow his crypto empire. A giant Ponzi Scheme.

It just got progressively worse, these documents alleged that from the very beginning of FTX's creation, FTX would take the money their customers deposited into their accounts and provide Alameda research unlimited access to them. Those funds would then be used to make speculative investments, pay for lavish real estate and even large political donations. However, when the crypto market started crashing in 2022 Alameda Research couldn't pay back the loans that were now being demanded from them, so FTX, by order of Sam Bankman-Fried, directed billions more of customers assets to Alameda Research to pay those loans. There was no meaningful distinction between FTX customer funds and Alameda's own funds.

Sam was looking at 115 years in prison. Then the Southern District of New York filed charges against Caroline Ellison the former CEO of Alameda Research and Gary Wong a cofounder of FTX in connection with their roles in the frauds. Within minutes they pled guilty to those charges. Obviously with deals to implicate SBF. Once the inner circle of Sam Bankman-Fried’s empire had now turned against him, he was extradited back to the United States to face the music. Amazingly SBF pled not guilty to the charges levied against him, setting himself up for a trial in October 2023.

FTX was a resounding failure on so many fronts and ultimately the price was paid not by Sam Bankman-Fried but by the real victims in this story, the people who he cheated. It's easy to throw around headlines with million dollar or even billion dollar losses, but the real losses came from those who didn't have millions to lose.

I could say that this story ends here but I don't think that's the case. Arguably one of the biggest catalysts for FTX's collapse began with CZ the owner of Binance. Throughout the years Binance has struggled with regulators and been plagued with allegations of allowing money laundering through its platform including hacker group Lazarus which funds the North Korean weapons program and Hydra which is a dark net drug dealing network.

Binance is a lot like FTX, has their own token called BNB, and just like FTX, Binance has one majority holder of that coin, CZ, in addition to being the majority owner of Binance. Binance is also associated with two other crypto trading firms much like Alameda Research, one of which, Merit Peak, has been reported to have received around $400 million from the US Binance exchange. It is unclear whether that money came from customer funds or not and if Binance have the coverage of one-to-one dollar as they claim. Binance did release a 'Proof of Reserves' audit from a third party, in an attempt to showcase their transparency and prove that all customer assets on the platform are fully backed. However, as of September 2023, that report has since been taken down by the firm who performed the audit citing “concerns over the way these reports are understood by the public” and that they have “limitations when providing assurances to customers”. Is this a red flag? Is this a company worried that their words will be misconstrued? Or is this a company worried to be associated with the next big crypto collapse?

Despite CZ and Binance starting the collapse of FTX by selling their accumulation of FTT and refusing to help FTX financially due to SBF helping the US government implement regulations on the crypto industry. I still believe that there needs to be regulation and accountability for digital finance companies. The S.E.C. is a civil organisation, it has no criminal jurisdiction, only financial penalties. However, if we mix that with the criminal law, enforced by the DOJ, and it forces companies to be accountable and law abiding, that would be a great comfort for retail investors. I understand that digital finance wants to be decentralised but while there is decentralisation, there will be criminals looking to scam innocent people like you and I, and I don't believe this industry will flourish while there is still that possibility.

As of August 2023, there has been over $700 million recovered in cryptocurrency which will be reparation to those who can prove they lost money on FTX. However, that doesn't come close to the tens of billions that customers lost in the FTX collapse of November 2022.

I will write a separate article about the outcome of SBF’s trial but I’d imagine that will continue until next year. Until then, trade safe.

Disclaimer - None of what is written on this website is financial advice and only descriptions of how the author trades and for entertainment purposes.

Comments